Credit Repair in Houston Texas

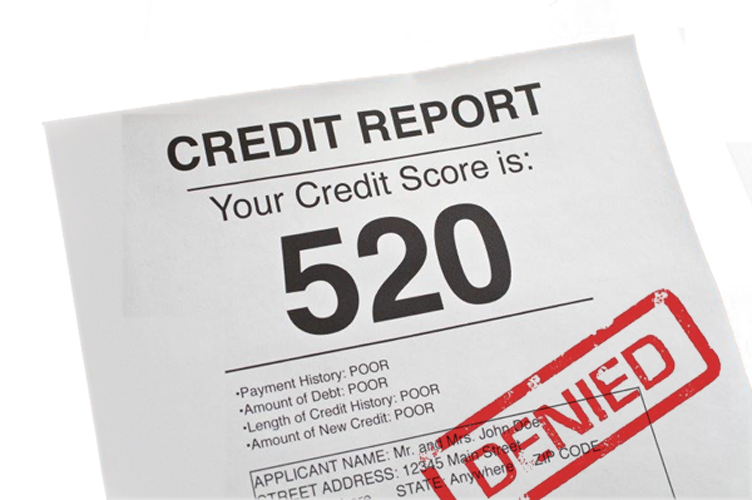

Restore Your Credit and Get Approved

We work with all three credit bureaus and your creditors to challenge the unfair or inaccurate negative report items that affect your credit score.

Read MoreWe offer 24/7 credit monitoring to keep you aware of the changes on your report and advise about how those reported items affect your score.

Read MoreOur educational approach and proven technology guide you through the tasks and action items you need to take in order to maintain a healthy score.

Read More